Payment Terms in Contracts

Introduction:

When it comes to contractual agreements, payment terms play a pivotal role in setting the financial expectations between parties involved. Essentially, payment terms define when and how money will be exchanged, making them a critical component of any business transaction. In this blog post, we will explore the meaning and significance of payment terms, the different types commonly found in contracts, their advantages and disadvantages, and practical insights for effective implementation.

Understanding Payment Terms:

Payment terms determine the timing and method of payment and are usually negotiated and agreed upon by both parties prior to the commencement of a contract. A well-defined payment term ensures clarity, transparency, and ultimately demonstrates trust between the parties involved.

Types of Payment Terms:

1. Net 30: This is one of the most common payment terms, where the buyer agrees to pay the seller within 30 days of receiving the goods or services. For instance, if you’re a graphic designer who just delivered a project, your client might pay you within 30 days from the project completion date.

Example: If a company purchases office supplies, they agree to pay the supplier within 30 days of receiving the supplies.

2. 2/10 Net 30: This term offers a discount (usually 2%) if the buyer pays within a shorter period, say 10 days, while the standard payment term remains 30 days. It’s a win-win, encouraging prompt payment while benefitting the buyer financially.

Example: If a company buys equipment, they can avail a 2% discount if they pay the invoice within 10 days; otherwise, the full payment is due within 30 days.

3. Due on Receipt: With this term, the payment is due immediately upon receipt of the goods or services. It’s particularly common for online transactions, where the buyer might pay upfront for a digital product or a subscription service.

Example: Online purchases often require due on receipt payment, where the buyer pays upfront for a digital product or a subscription.

4. Milestone-Based: In complex projects, payments are tied to specific milestones. For instance, in a software development project, payments might be triggered upon completion of design, coding, and testing phases.

Example: In a construction project, payments could be linked to the completion of foundation work, structural framing, and final finishing.

5. Advance Payment: The buyer pays a certain percentage of the total amount upfront before goods or services are delivered.

Example: A photographer might request a 50% advance payment before an event and the remaining amount after delivering the photos.

6. Recurring Payments: Payments are made at regular intervals, often monthly or annually, for ongoing services or subscriptions.

Example: Monthly software subscription fees or retainer payments for legal services fall under recurring payment terms.

7. Deferred Payment: The total payment is split into installments over a specified period after the delivery of goods or completion of services.

Example: A furniture store might offer deferred payment terms where a customer can pay for a couch over six months.

8. Letter of Credit: A financial institution guarantees payment to the seller as long as the required documentation is provided.

Example: In international trade, a letter of credit ensures that the seller receives payment when goods are shipped and documents are presented.

9. Cash on Delivery (COD): Payment is collected at the time of delivery.

Example: A food delivery service often uses COD, where the customer pays the delivery person upon receiving their order.

Advantages and Disadvantages

Advantages:

Cash Flow Management: Longer payment terms can provide flexibility in managing cash flow. However, offering discounts for prompt payment can incentivize quicker payments, benefiting both parties.

Risk Mitigation: Shorter payment terms reduce the risk of non-payment or delayed payment, safeguarding the seller’s financial stability.

Relationship Preservation: Fair payment terms can build trust between parties, enhancing long-term partnerships.

Disadvantages:

Cash Flow Crunch: Longer payment terms might strain the seller’s cash flow, especially for small businesses.

Discount Costs: Offering discounts for early payment can reduce the seller’s profit margin.

Administrative Burden: Handling frequent smaller payments from multiple clients under short terms can be administratively demanding.

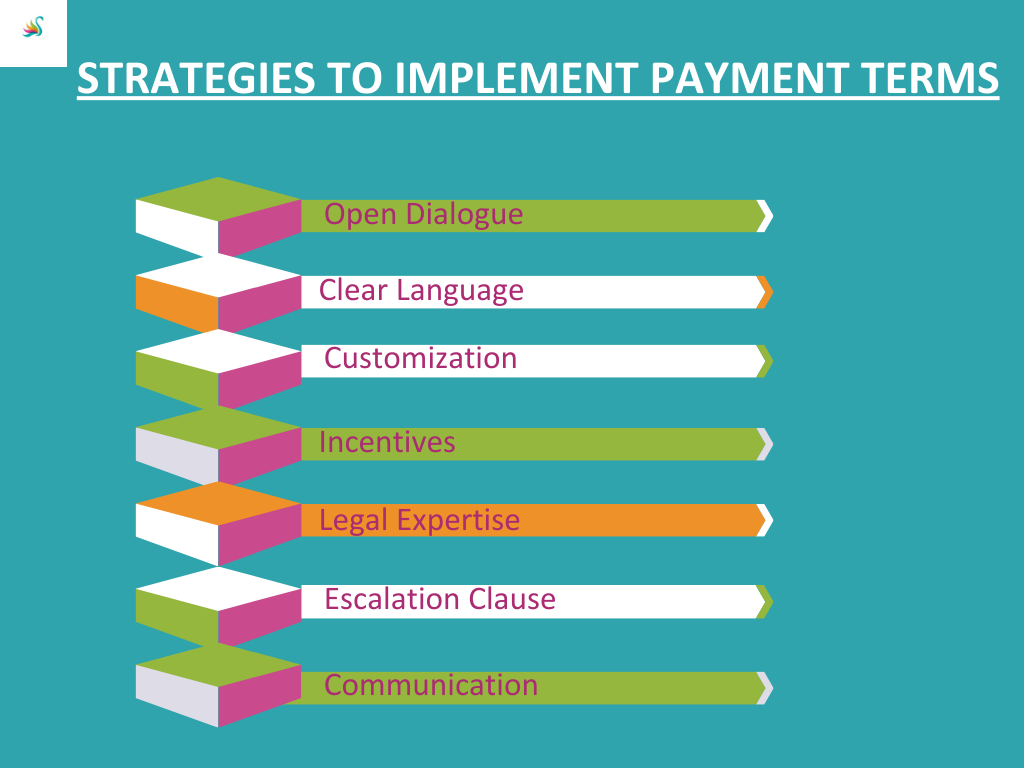

Implementing Payment Terms Effectively:

To implement payment terms effectively, consider the following strategies, best practices, and potential pitfalls

Open Dialogue: Discuss payment terms upfront and ensure both parties are comfortable with the arrangement before finalizing the contract.

Clear Language: Use unambiguous language in the contract to avoid misunderstandings. Define payment due dates, methods, and any applicable penalties for late payments.

Customization: Tailor payment terms to the nature of the project and the financial capabilities of both parties. One size doesn’t fit all.

Incentives: Consider offering discounts for early payment or penalties for late payment to ensure timely transactions.

Legal Expertise: Seek legal advice to ensure your payment terms align with local laws and regulations.

Escalation Clause: Include a clause specifying the actions to be taken if payments are delayed or not received.

Communication: Maintain open lines of communication throughout the project to address any potential payment issues promptly.

Pitfalls to Avoid:

Ambiguity: Vague payment terms can lead to disputes. Ensure clarity in language and expectations.

Ignoring Industry Norms: Research common payment terms in your industry to ensure competitiveness and fairness.

Overlooking Reciprocity: While you want secure payment, also consider the buyer’s perspective and their ability to comply.

Conclusion:

Payment terms in contracts serve as a foundation for successful business transactions by defining the financial expectations between parties. By understanding the various types of payment terms, their advantages and disadvantages, and implementing them effectively, businesses can significantly mitigate risks, manage cash flow, and foster healthy relationships. So, next time you negotiate a contract, ensure that payment terms are given the attention they deserve, as they can make or break a successful business relationship.