Bank Guarantees in Contracts

Introduction of Bank Guarantees in a Construction Project:

Bank guarantees are commonly used in construction projects as a form of security to ensure that the contractor fulfills their obligations under the contract. They provide the owner of the project with financial protection in case the contractor fails to perform as required.

The use of bank guarantees in construction projects can provide several benefits for both the owner and the contractor. For the owner, bank guarantees provide a measure of security that the contractor will complete the work as per the contract, and that any advance payments or retention money will be returned if the contract is terminated. For the contractor, bank guarantees can help to secure financing for the project and can provide a level of assurance that they will be paid for the work they perform.

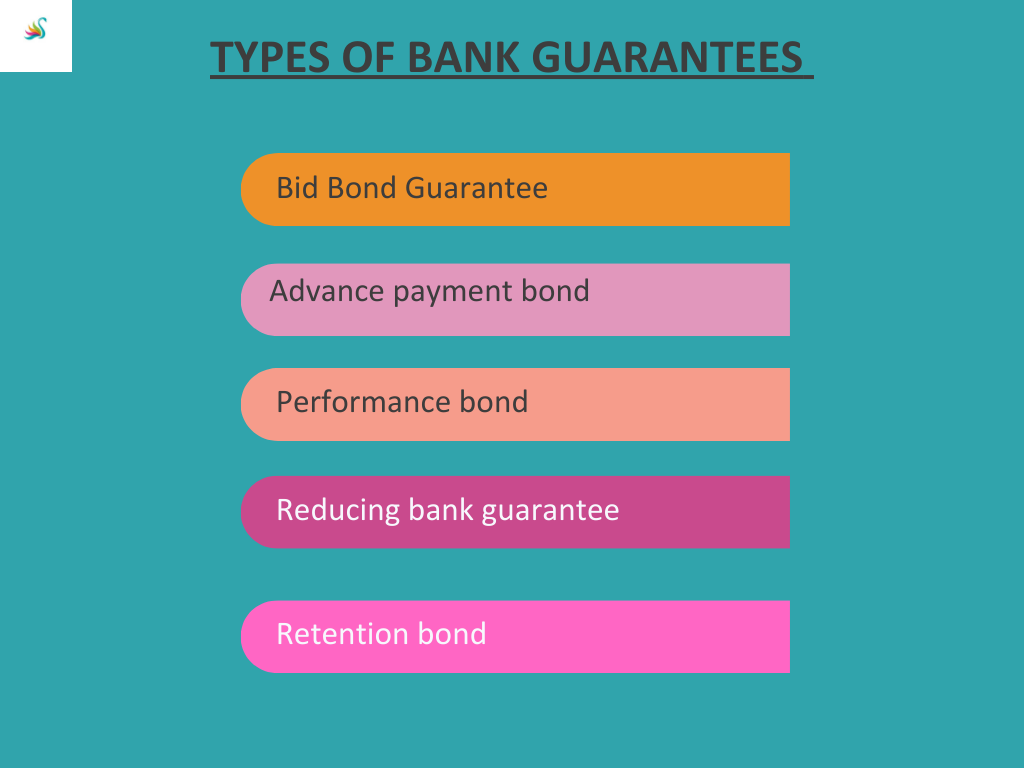

There are several types of bank guarantees that may be used in a construction project, including bid bond Guarantee, performance bonds, advance payment bonds, and retention bonds. Each type of guarantee serves a specific purpose and provides a different level of protection for the owner and the contractor.

It’s important to note that the specific types of guarantees required may vary depending on the terms of the contract, the laws of the jurisdiction in which the construction project is located, and the size and complexity of the project.

Types of bank guarantees that may be required in an EPC contract:

1. Bid Bond Guarantee/Earnest Money Deposit: This is a type of Performance Bank Guarantee that is issued to the client during the bidding process. It assures the client that the contractor will enter into the contract if their bid is accepted.

2. Advance Payment Bond/Advance Bank Guarantee: This guarantee is also issued by the contractor’s bank and is intended to protect the owner from financial losses if the contractor fails to return an advance payment if the contract is terminated for any reason.

3. Performance Bond/Performance Bank Guarantee: This guarantee is issued by the contractor’s bank and is intended to protect the owner of the power plant from financial losses if the contractor fails to perform their obligations under the contract.

4. Reducing Bank Guarantee: A reducing bank guarantee is a type of guarantee in which the amount of the guarantee is gradually reduced over time, typically as the contractor completes certain milestones or stages of the construction project.

5. Retention Bond/Retention Bank Guarantee: This guarantee is issued by the contractor’s bank and is intended to ensure that the contractor will return the retention money held by the owner as per contract, after the completion of the project.

1. Bid Bonds Guarantee/Earnest Money Deposit:

Bid bonds are used during the tendering process to ensure that bidders (contractors or suppliers) remain committed to their submitted bids and proceed with the contract if selected by the project owner. Bid bonds provide reassurance to the project owner that the bidder will sign the contract and provide the required performance guarantee if awarded the project.

Requirements:

a. Monetary Value: Bid bonds usually have a specific monetary value, typically a percentage of the bid price, which should be agreed upon by the parties involved.

b. Validity Period: Bid bonds are generally valid for a specific period, often until the selection of the winning bid or the completion of the tender evaluation process.

c. Release or Retention: Once the contract is awarded, bid bonds are either released or converted into performance guarantees. The terms regarding the transition should be explicitly stated.

2. Advance Bank Guarantee

Process and Purpose of Advance bank guarantee in a Contract.

An advance payment bond, also known as an advance bank guarantee, is a type of guarantee that is issued by the contractor’s bank and is intended to protect the owner of the construction project from financial losses if the contractor fails to return an advance payment if the contract is terminated for any reason.

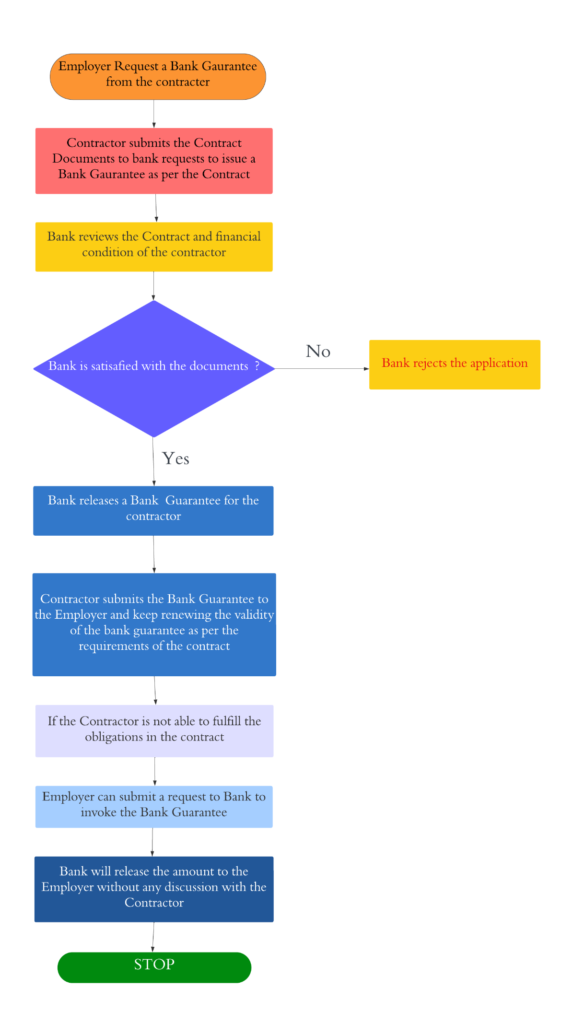

The process for obtaining an advance payment bond typically involves the following steps:

1. The owner of the construction project requests an advance payment bond from the contractor.

2. The contractor applies for the bond from their bank, who will then evaluate the contractor’s creditworthiness and the terms of the contract before issuing the bond.

3. Once the bond is issued, the owner will typically be required to pay the contractor an advance payment, which is then held in escrow by the bank.

4. If the contractor fails to perform their obligations under the contract and the contract is terminated, the owner can make a claim on the bond to recover the advance payment.

The purpose of an advance payment bond is to provide the owner with a measure of security that they will be able to recover any advance payments they make to the contractor if the contract is terminated for any reason. This type of guarantee can also serve as a tool for the contractor to secure financing for the project.

Case laws referring to Advance bank guarantees in a project:

One example of a case involving advance bank guarantees in a construction project is the case of Essar Projects India Ltd. v. Videocon Industries Ltd.

Case Background:

Essar Projects India Ltd. (EPIL) and Videocon Industries Ltd. (VIL) entered into a contract for EPIL to construct a power plant for VIL. As per the contract, EPIL provided an advance bank guarantee to VIL to secure the advance payment made by VIL. However, EPIL failed to complete the project within the stipulated time, resulting in VIL terminating the contract and encashing the advance bank guarantee.

EPIL challenged the encashment of the advance bank guarantee by VIL and sought an injunction against VIL from invoking the bank guarantee. The matter was referred to arbitration, where the arbitrator passed an award in favor of VIL, stating that the bank guarantee was unconditional and could be encashed by VIL without any prior notice to EPIL. EPIL challenged the arbitration award in the High Court of Bombay.

Legal Issues:

The primary legal issue in this case was whether an advance bank guarantee provided by a contractor to a principal can be encashed by the principal without giving any notice to the contractor.

Court’s Decision:

The High Court of Bombay upheld the arbitration award and dismissed the petition filed by EPIL. The court held that the advance bank guarantee was unconditional and could be encashed by VIL without giving any prior notice to EPIL. The court observed that the purpose of an advance bank guarantee was to provide security for the advance payment made by the principal to the contractor and to ensure that the contractor performs the contract. The court further noted that the advance bank guarantee was not a performance guarantee and therefore, VIL was entitled to encash it without any notice to EPIL.

The court relied on various precedents, including the Supreme Court’s decision in Union of India v. Raman Iron Foundry, to hold that an advance bank guarantee is an independent contract between the bank and the principal, and the bank’s obligation to pay the principal is not affected by any dispute between the principal and the contractor.

Implications:

The Essar Projects India Ltd. v. Videocon Industries Ltd. case is significant as it clarifies the legal position regarding advance bank guarantees. The court’s decision has established that an advance bank guarantee is an unconditional undertaking by the bank to pay the principal and is independent of the underlying contract between the principal and the contractor.

The ruling has significant implications for contractors, as it means that they cannot challenge the encashment of an advance bank guarantee by a principal, even if there is a dispute between the parties. The ruling also clarifies that the bank’s obligation to pay the principal is not affected by any disputes between the parties.

The court’s reasoning and legal principles applied in the case are consistent with the established legal position regarding bank guarantees. The ruling is likely to have a significant impact on future cases involving advance bank guarantees, as it clarifies the legal position and provides guidance to parties entering into such contracts.

3. Performance Bank Guarantee:

Process and Purpose of Performance Bank guarantee in a Contract

A Performance bond, also known as a Performance guarantee, is a type of guarantee that is issued by the contractor’s bank and is intended to protect the owner of the construction project from financial losses if the contractor fails to perform their obligations under the contract.

The process for obtaining a Performance bond typically involves the following steps:

1. The owner of the construction project requests a Performance bond from the contractor.

2. The contractor applies for the bond from their bank, who will then evaluate the contractor’s creditworthiness and the terms of the contract before issuing the bond.

3. Once the bond is issued, the owner can call for the bond in case of non-performance by the contractor.

4. The contractor’s bank will pay the claim to the owner, up to the bond amount, and the contractor will be liable to repay the bank.

The purpose of a Performance bond is to provide the owner with a measure of security that the contractor will complete the work as per the contract. This type of guarantee also serves as a tool for the contractor to secure financing for the project and to demonstrate their ability to fulfill the contract, by obtaining a performance bond from a reputable bank.

It’s important to note that the Performance bond may require a collateral deposit from the contractor, and may also have a certain percentage that the owner can claim in case of non-performance. Also, the terms and conditions of the guarantee will be defined in the contract and may vary depending on the laws of the jurisdiction in which the construction project is located.

4.Reducing Bank Guarantee:

Concept of reducing bank guarantee

A reducing bank guarantee is a type of guarantee in which the amount of the guarantee is gradually reduced over time, typically as the contractor completes certain milestones or stages of the construction project. The purpose of a reducing bank guarantee is to provide the owner with a measure of security while also providing the contractor with an incentive to complete the work in a timely manner.

The process for obtaining a reducing bank guarantee typically involves the following steps:

1. The owner of the construction project requests a reducing bank guarantee from the contractor as a part of the bidding process.

2. The contractor applies for the guarantee from their bank, who will then evaluate the contractor’s creditworthiness and the terms of the contract before issuing the guarantee.

3. The amount of the guarantee is set at a certain percentage of the contract value, and it is gradually reduced as the contractor completes certain milestones or stages of the project.

4. Once the project is completed, the guarantee amount is reduced to zero.

The reducing bank guarantee can serve as an incentive for the contractor to complete the work on time and to the satisfaction of the owner, as the contractor would want to reduce the amount of the guarantee held by the bank. This type of guarantee can also serve as a tool for the contractor to secure financing for the project and to demonstrate their ability to fulfill the contract, by obtaining a reducing bank guarantee from a reputable bank.

It’s important to note that the terms and conditions of the reducing bank guarantee will be defined in the contract and may vary depending on the laws of the jurisdiction in which the construction project is located. The percentage of reduction, the milestones, and the notice period for the reduction are also defined in the contract.

An example of the operational aspect of a reducing bank guarantee in a construction project would be as follows:

- A construction company is awarded a contract to build a new office building for a company. The contract value is $10 million.

- As part of the contract, the company is required to provide a reducing bank guarantee of 10% of the contract value, or $1 million.

- The project is divided into four stages: excavation, foundation, superstructure, and completion.

- Upon completion of the excavation stage, the company can submit a request to the bank to reduce the guarantee amount by 25%. This means that the guarantee amount would be reduced to $750,000.

- Upon completion of the foundation stage, the company can submit a request to the bank to reduce the guarantee amount by another 25%. This means that the guarantee amount would be reduced to $562,500.

- Upon completion of the superstructure stage, the company can submit a request to the bank to reduce the guarantee amount by another 25%. This means that the guarantee amount would be reduced to $421,875.

- Upon completion of the completion stage and final inspection, the company can submit a request to the bank to reduce the guarantee amount by the final 25%. This means that the guarantee amount would be reduced to $315,906 and the guarantee would expire.

It’s important to note that the milestones, percentage of reduction and the notice period for the reduction are defined in the contract and may vary depending on the project. The bank may also conduct an inspection to confirm that the milestones have been achieved before reducing the guarantee amount.

5. Retention Guarantees:

Retention guarantees are utilized when project owners retain a portion of the payment due to the contractor until the satisfactory completion of specific project milestones or a defined defects liability period. This guarantee protects project owners from potential defects, maintenance issues, or non-compliance detected after project completion.

Requirements:

a. Monetary Value: The guarantee is typically a percentage of the retention amount or the contract value, as specified in the contract.

b. Validity Period: Retention guarantees are valid until the expiration of the defects liability period or until project milestones have been completed, as mutually agreed upon.

c. Claims Process: The guarantee should outline the process for the project owner to make a claim if defects or non-compliance are identified during the defects liability period.

Flow chart Showing the Bank Guarantee Process

Validity of a Bank Guarantee:

The validity of a bank guarantee is the period of time during which the guarantee is valid and enforceable. The validity period for a bank guarantee can be different depending on the contract and the laws of the jurisdiction in which the construction project is located.

The validity period for a bank guarantee can be tied to the completion date of the project or a specific date agreed upon by the parties. Some bank guarantees have a validity period of a year, while others may be valid for a longer period. The validity period may be extended if the owner agrees with the extension request.

The bank guarantee is only valid and enforceable during the validity period and the owner can only make a claim during this period. The guarantee is no longer valid when the validity period is over.

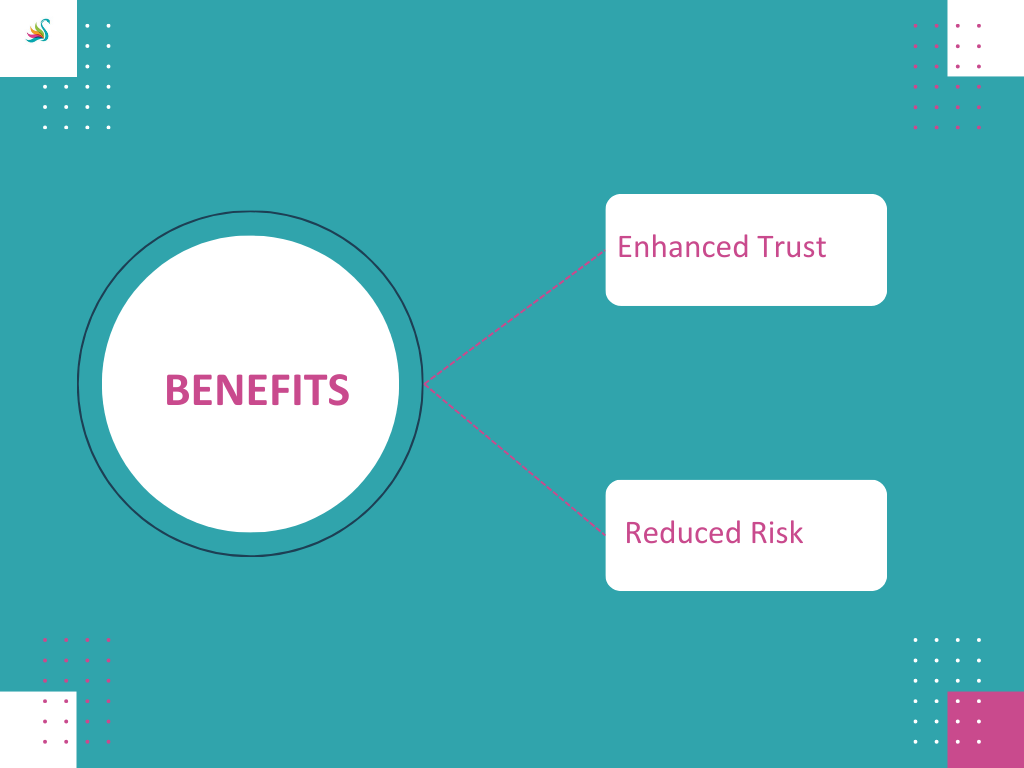

Benefits of Bank Guarantees:

a) Enhanced Trust: Bank guarantees enhance trust between parties by providing a financial safety net, reassuring the beneficiary that the guarantor will uphold the contractual commitments.

b) Reduced Risk: Bank guarantees mitigate the risk most significantly for the beneficiary. Due to the involvement of a reliable financial institution, the risk of non-payment or non-performance is transferred to the guarantor.

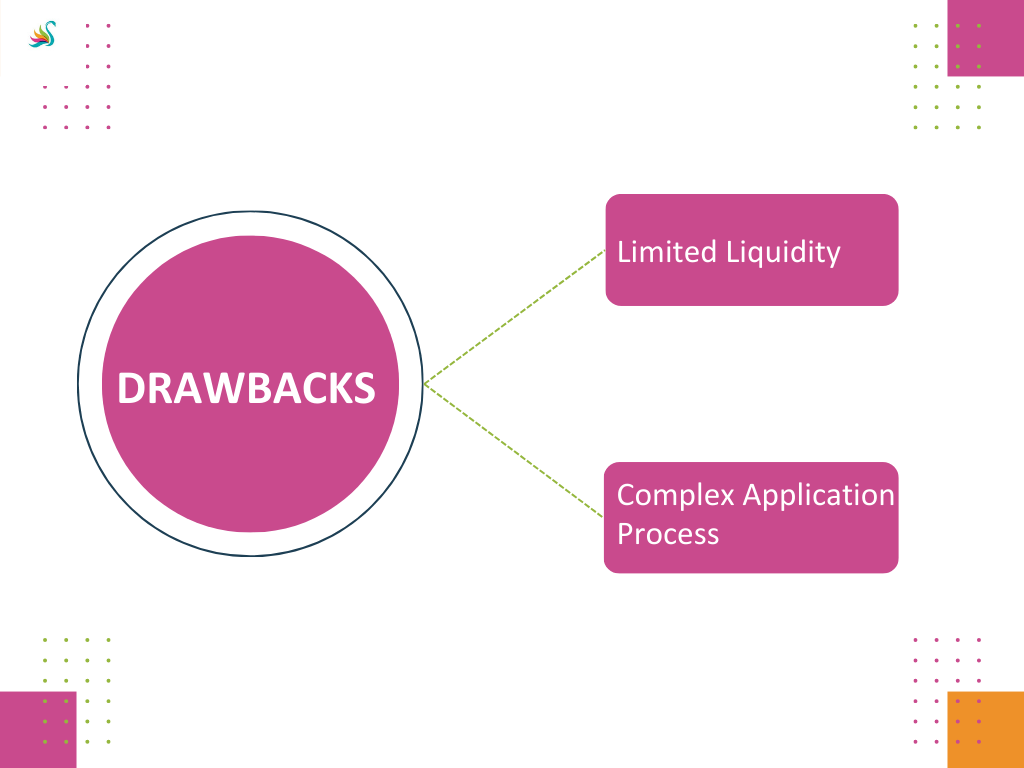

Drawbacks and Limitations of Bank Guarantees:

a) Limited Liquidity: In some cases, guarantors may require the setting aside of funds or assets as collateral, tying up valuable resources.

b) Complex Application Process: The process of obtaining a bank guarantee can be time-consuming and involve extensive documentation, potentially delaying contractual processes.

Real-life Examples and Case Studies:

a) In the construction industry, performance guarantees are commonly used to ensure the timely and satisfactory completion of projects. Failure to fulfill these obligations can lead to the bank compensating the buyer for delays or poor quality work.

b) International trade frequently employs payment guarantees to protect both importers and exporters from non-payment risks, ensuring a smooth flow of trade.

Expert Analysis and Opinion:

Bank guarantees continue to play a vital role in modern business practices. They offer a practical solution to mitigate risks and instill confidence between parties involved in contracts. While the process may be burdensome, the trust and financial security provided by bank guarantees significantly outweigh the drawbacks.

Conclusion:

Bank guarantees offer crucial financial assurance and risk mitigation in contractual agreements. By understanding the different types of bank guarantees and analyzing their benefits and drawbacks, businesses can make informed decisions when incorporating them into their contracts. With the help of real-life examples and case studies, it is evident that bank guarantees have a wide range of applications across various industries, ensuring a smoother and more predictable business environment.