Risk Management in Project and Contract Management

Definition of Risk Management:

Risk Management in the context of Project and Contract Management refers to the systematic process of identifying, assessing, mitigating, and monitoring potential risks and uncertainties that could impact the successful completion of a project or a contractual agreement. It involves identifying potential threats and opportunities, analyzing their potential impact on project objectives and contractual obligations, and developing strategies to minimize negative consequences or enhance positive outcomes.

Significance of Risk Management in Project and Contract Management:

Effective Risk Management is of paramount importance in both project and contract management for the following reasons:

In Project Management:

1. Proactive Approach: Risk Management allows project managers to take a proactive approach to address potential issues before they escalate, ensuring a smoother project execution.

2. Resource Allocation: By identifying and prioritizing risks, project managers can allocate resources more efficiently and focus on critical areas.

3. Stakeholder Communication: Risk Management enhances communication with stakeholders by addressing concerns and demonstrating that the project team is prepared for potential challenges.

4. Improved Decision-Making: It enables informed decision-making by considering risks and their potential impact on project outcomes.

5. Timely Delivery: Effective Risk Management helps in delivering projects on time, within budget, and meeting the desired quality standards.

In Contract Management:

1. Risk Allocation: Identifying risks in contracts helps in allocating responsibilities and liabilities to the parties involved appropriately.

2. Contract Compliance: Effective Risk Management ensures that contractual obligations are met, reducing the likelihood of disputes and legal issues.

3. Financial Security: By understanding and mitigating contract-related risks, organizations can safeguard their financial interests.

4. Relationship Management: Identifying potential risks allows for early communication with contractors, fostering a positive and collaborative relationship.

5. Enhanced Performance: Risk Management helps to ensure that both parties are aware of potential challenges, leading to improved performance and successful contract execution.

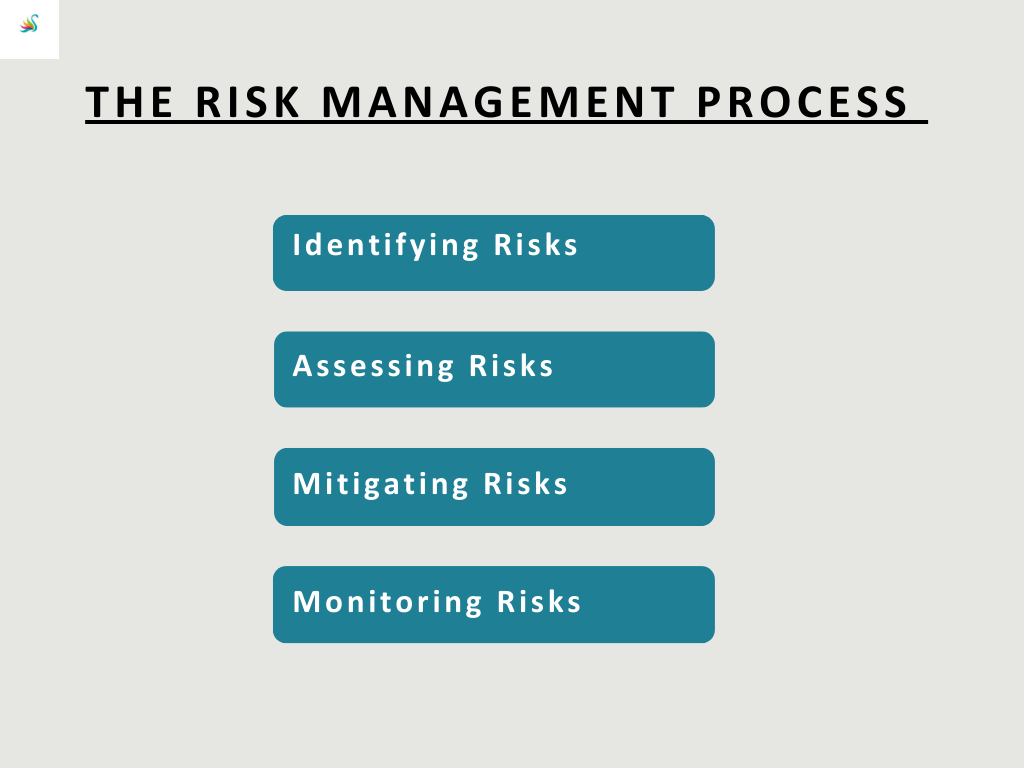

The Risk Management Process in Projects and Contracts

(1) Identifying Risks

The first step in the Risk Management process for both projects and contracts is to identify potential risks. This involves systematically gathering information, brainstorming with relevant stakeholders, and using various techniques to uncover risks.

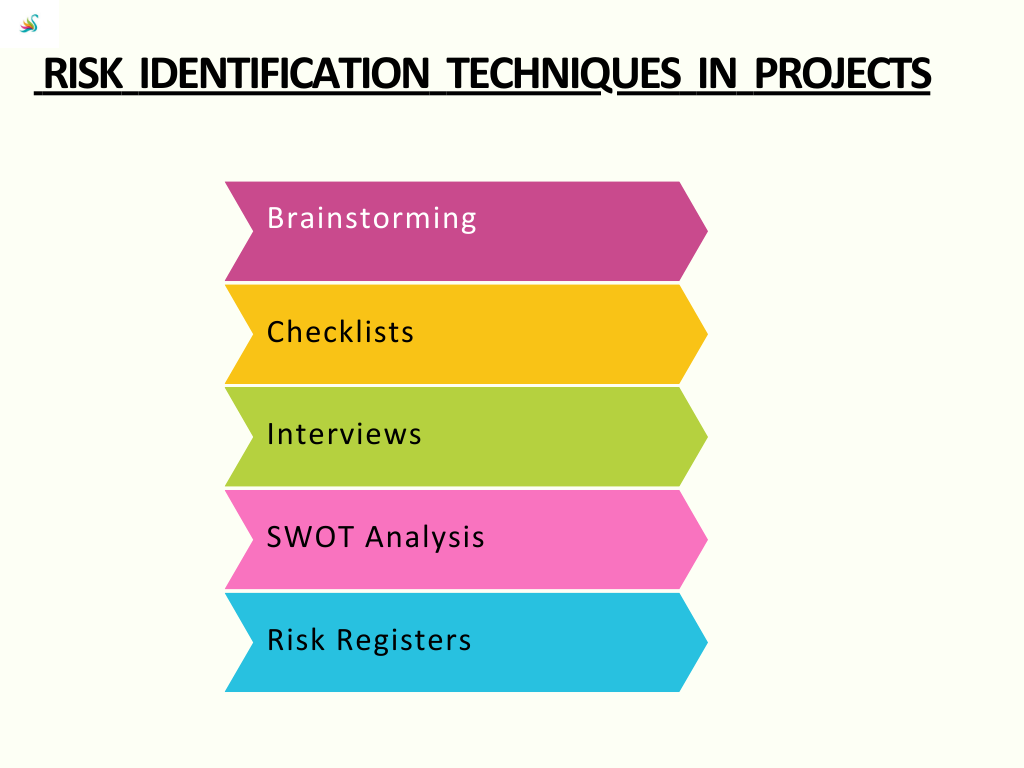

Risk Identification Techniques in Projects:

- Brainstorming: Conducting group sessions with project team members and stakeholders to generate a comprehensive list of potential risks.

- Checklists: Using historical project data, industry-specific checklists, or lessons learned from previous projects to identify common risks.

- Interviews: Discussing the project with subject matter experts, team members, and stakeholders to gain insights into potential risks.

- SWOT Analysis: Analyzing project strengths, weaknesses, opportunities, and threats to identify risks and opportunities.

- Risk Registers: Reviewing existing risk registers from similar projects to identify potential risks.

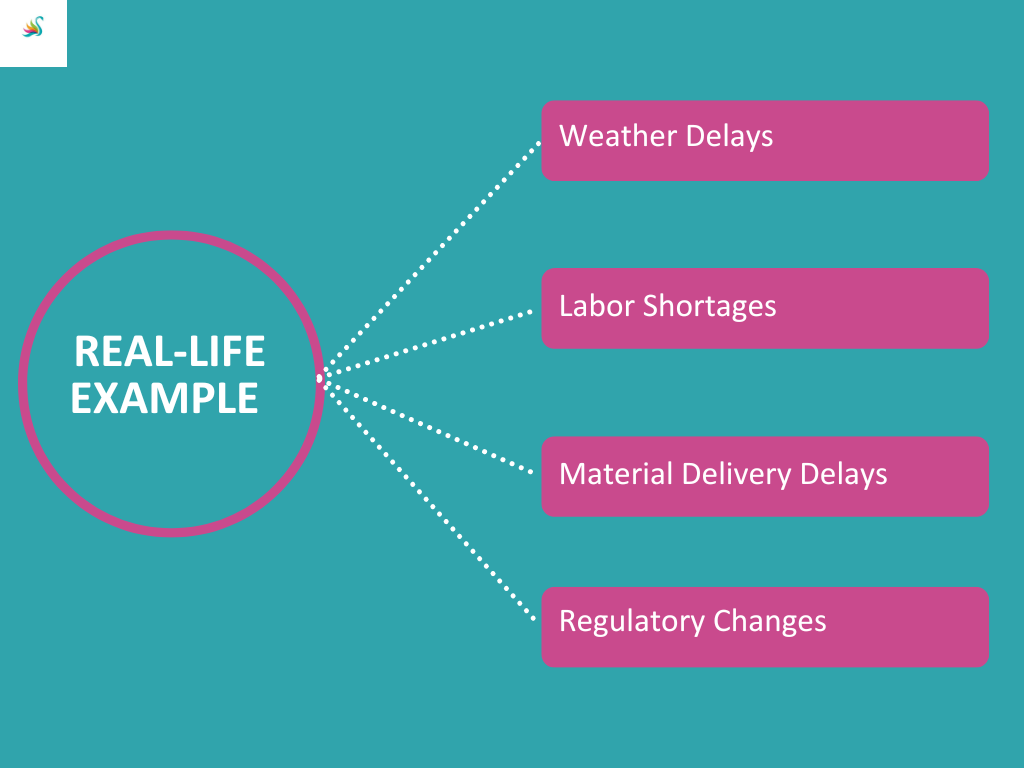

Real-Life Example: Project Risk Identification

In a construction project, the project team identified the following potential risks:

1. Weather Delays: Unfavorable weather conditions could impact construction schedules.

2. Labor Shortages: Scarcity of skilled labor in the local area might cause delays in project execution.

3. Material Delivery Delays: Delays in receiving construction materials might hamper progress.

4. Regulatory Changes: Changes in local building codes or regulations could require alterations in the construction plan.

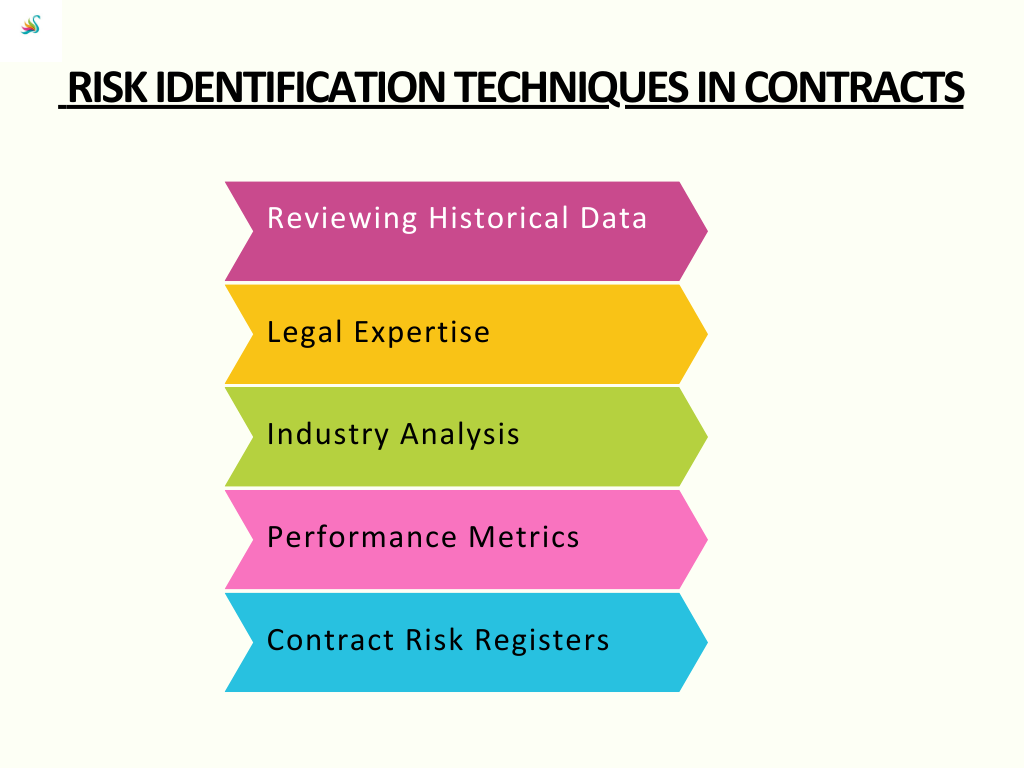

Risk Identification Techniques in Contracts:

- Reviewing Historical Data: Analyzing previous contracts to identify common risk areas and patterns.

- Legal Expertise: Engaging legal experts to review the contract and identify potential legal and compliance risks.

- Industry Analysis: Understanding industry-specific risks that may impact the contract’s success.

- Performance Metrics: Identifying key performance indicators (KPIs) and performance targets that are critical to contract success.

- Contract Risk Registers: Reviewing existing contract risk registers or databases to identify potential risks.

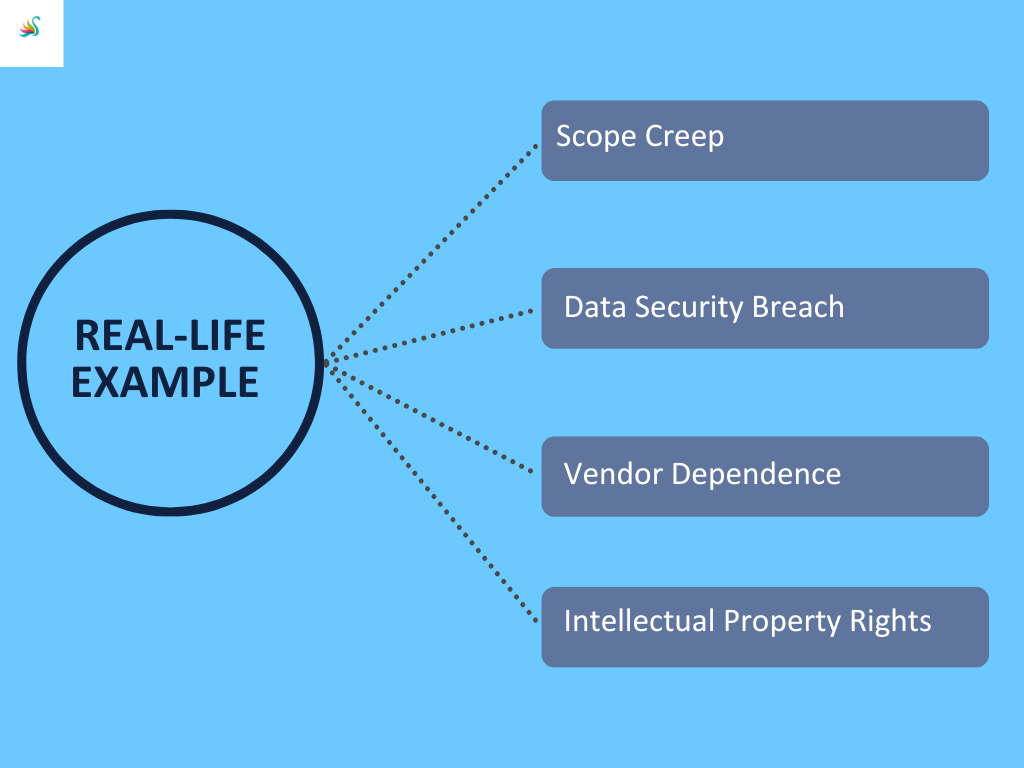

Real-Life Example: Contract Risk Identification

In a software development contract, the parties identified the following potential risks:

1. Scope Creep: The client might request additional features that were not initially part of the contract.

2. Data Security Breach: The risk of a data breach leading to potential legal liabilities and reputational damage.

3. Vendor Dependence: The client becomes overly dependent on the software vendor, leading to difficulties in transition or continuity.

4. Intellectual Property Rights: Risks related to the ownership and protection of intellectual property developed during the contract.

(2) Assessing Risks

After identifying risks, the next step is to assess their potential impact and likelihood of occurrence. This allows project and contract managers to prioritize risks based on their significance.

Risk Assessment Techniques in Projects:

Qualitative Risk Analysis: Using subjective scales (e.g., low, medium, high) to assess the impact and likelihood of each risk.

Quantitative Risk Analysis: Using numerical values and data to calculate risk scores and potential losses more precisely.

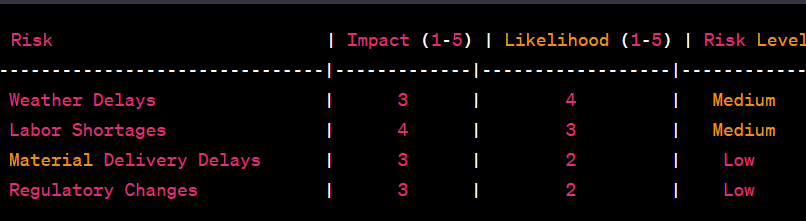

Real-Life Example: Project Risk Assessment

For the construction project, the project team assessed the identified risks using qualitative analysis. They rated each risk on a scale of 1 to 5 for impact and likelihood.

Risk Assessment Techniques in Contracts:

- Legal Analysis: Evaluating the potential legal and contractual impact of identified risks.

- Financial Analysis: Assessing the financial implications of contract-related risks.

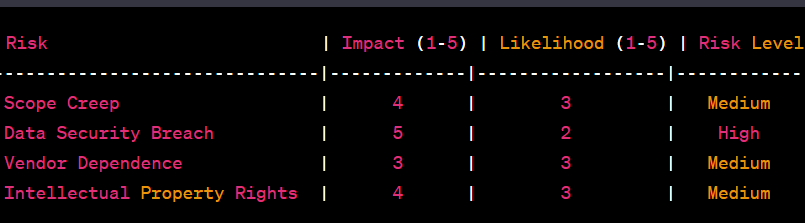

Real-Life Example: Contract Risk Assessment

For the software development contract, the parties assessed the identified risks using qualitative analysis. They rated each risk on a scale of 1 to 5 for impact and likelihood.

(3) Mitigating Risks

After assessing the risks, both project and contract managers develop strategies to mitigate or reduce the impact and likelihood of occurrence.

Risk Mitigation Techniques in Projects:

1. Risk Avoidance: Changing project plans or scope to avoid high-risk activities or stakeholders.

2. Risk Transfer: Shifting the responsibility for managing the risk to a third party, such as through insurance or outsourcing.

3. Risk Reduction: Implementing measures to decrease the probability or impact of a risk occurring.

4. Risk Acceptance: Acknowledging a risk’s existence but deciding not to take any specific action.

Real-Life Example: Project Risk Mitigation

For the identified risks in the construction project, the team decided on the following mitigation strategies:

1. Weather Delays: Incorporating weather contingencies in the project schedule and considering alternative construction methods.

2. Labor Shortages: Developing a resource contingency plan and exploring partnerships with local construction agencies.

3. Material Delivery Delays: Establishing strong communication with suppliers and identifying backup suppliers.

4. Regulatory Changes: Engaging with local authorities to stay updated on any potential changes and proactively adapting to new regulations.

Risk Mitigation Techniques in Contracts:

- Contractual Provisions: Incorporating specific contractual clauses to address identified risks.

- Performance Guarantees: Setting performance guarantees and penalties for non-compliance.

- Indemnity and Liability: Specifying indemnity and liability clauses to allocate risk between parties.

Real-Life Example: Contract Risk Mitigation

For the software development contract, the parties decided on the following mitigation strategies:

1. Scope Creep: Clearly defining the scope of work in the contract and implementing a formal change request process.

2. Data Security Breach: Implementing robust security measures and obtaining cyber insurance.

3. Vendor Dependence: Including a transition plan in the contract and ensuring knowledge transfer.

4. Intellectual Property Rights: Defining ownership and usage rights for intellectual property created during the project.

(4) Monitoring Risks:

Risk Management is an ongoing process that requires continuous monitoring and updating. This involves tracking identified risks, evaluating the effectiveness of mitigation strategies, and identifying new risks that may arise during the project or contract lifecycle.

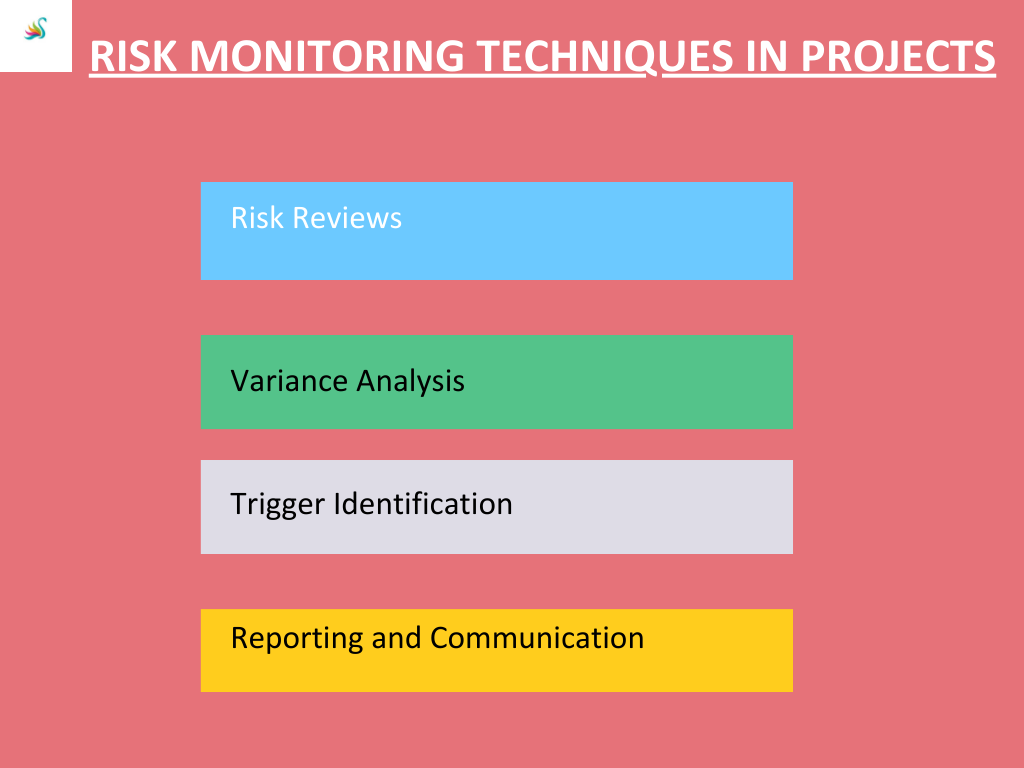

Risk Monitoring Techniques in Projects:

1. Risk Reviews: Regularly reviewing risk registers and updating risk information as needed.

2. Variance Analysis: Analyzing discrepancies between planned and actual project outcomes to identify emerging risks.

3. Trigger Identification: Defining triggers or thresholds that indicate a risk is materializing or worsening.

4. Reporting and Communication: Ensuring effective communication about risks across project stakeholders.

Real-Life Example: Project Risk Monitoring

In the construction project, the team conducted monthly risk reviews, assessed progress against trigger thresholds, and updated stakeholders through regular status reports.

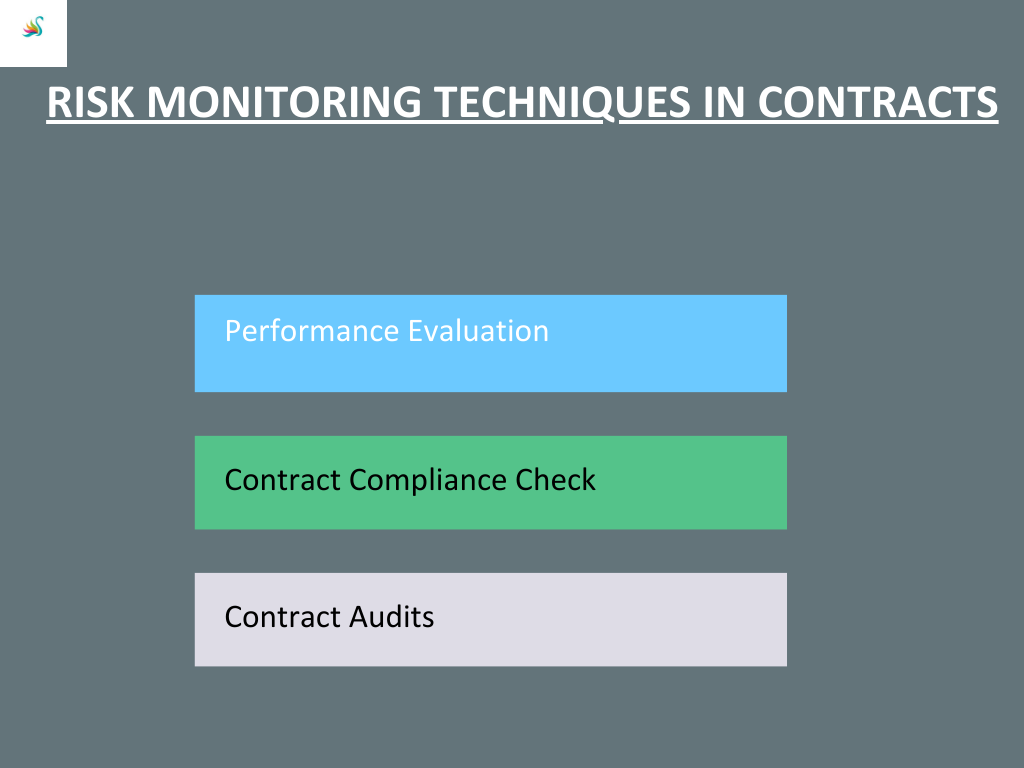

Risk Monitoring Techniques in Contracts:

- Performance Evaluation: Regularly evaluating the performance of both parties against predefined KPIs.

- Contract Compliance Check: Ensuring both parties adhere to the contract’s terms and conditions.

- Contract Audits: Conducting periodic contract audits to identify compliance gaps and potential risks.

Real-Life Example: Contract Risk Monitoring

-

In the software development contract, the parties monitored the risks through regular progress meetings, contract compliance checks, and performance evaluations based on predefined milestones.

Risk Management Matrix in Projects and Contracts:

-

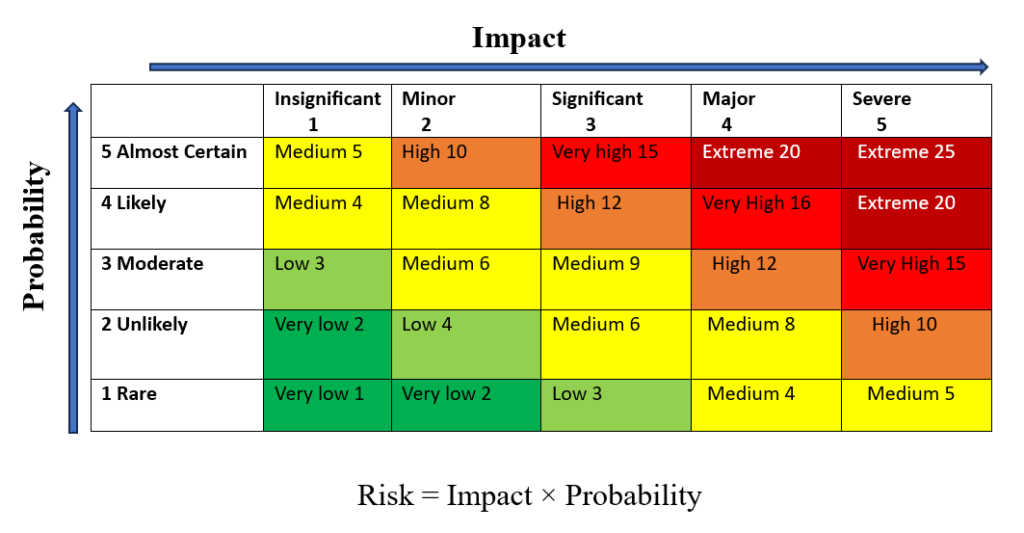

A Risk Management Matrix, also known as a Risk Matrix or Risk Heat Map, is a visual representation of identified risks, their likelihood, and potential impact. The matrix serves several purposes:

1. Risk Prioritization: The matrix helps prioritize risks based on their severity, allowing project and contract teams to focus on high-priority risks.

2. Communication: It facilitates effective communication of risk information to stakeholders, providing a clear and concise overview of risk exposure.

3. Decision-Making: The matrix aids in decision-making by providing a clear understanding of which risks require immediate attention and which can be managed later.

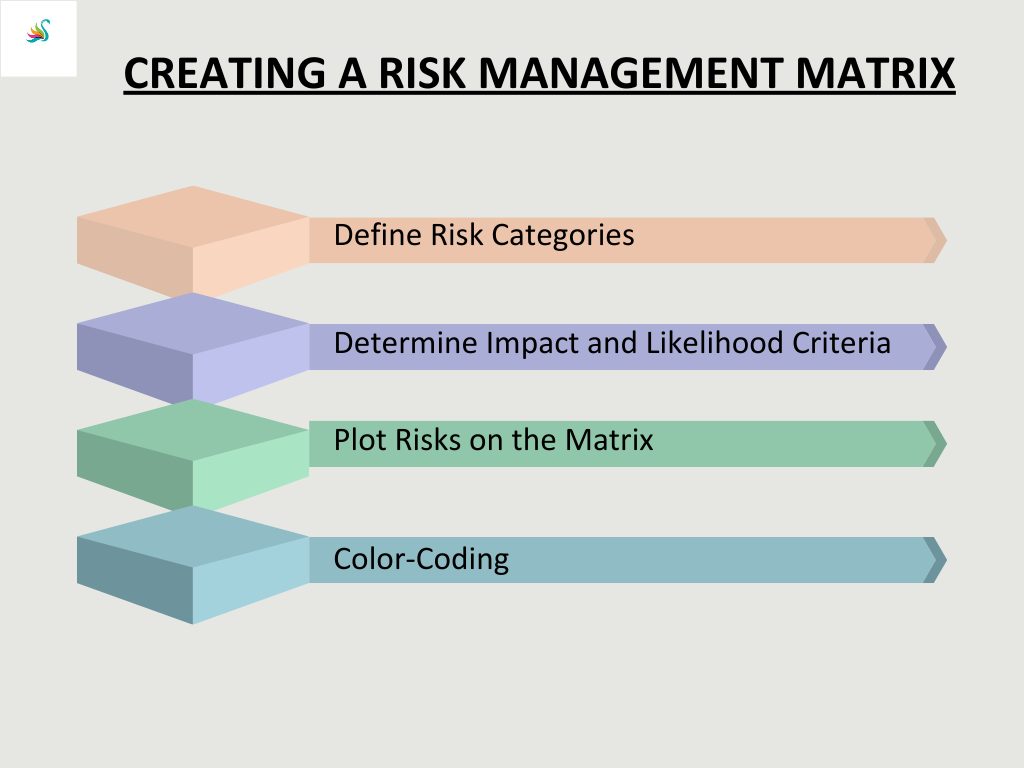

Creating a Risk Management Matrix:

To create a Risk Management Matrix, follow these steps:

Step 1: Define Risk Categories

Start by defining the categories in which risks will be classified. Common categories include scope, schedule, cost, quality, resources, technology, and external factors.

Step 2: Determine Impact and Likelihood Criteria

Develop a scale for both impact and likelihood. The scale should be tailored to the project or contract’s context, and common approaches include numeric scales (e.g., 1 to 5) or descriptive scales (e.g., Low, Medium, High).

Step 3: Plot Risks on the Matrix

For each identified risk, assess its impact and likelihood and plot it on the Risk Management Matrix. The intersection of the impact and likelihood values will determine its position on the matrix.

Step 4: Color-Coding

Color-code the cells in the matrix to visually represent risk severity. For instance, green cells might represent low-risk areas, yellow cells moderate-risk areas, and red cells high-risk areas.

Examples of a 5x5 Risk Matrix

Probability (Likelihood) Levels:

1. Rare: “Rare” likelihood signifies that the event is highly unlikely to occur. It might only happen in exceptional circumstances or very rarely.

2. Unlikely: Events with an “Unlikely” likelihood have a low probability of happening. They might occur infrequently or under specific circumstances.

3. Moderate: “Moderate” likelihood indicates a reasonable chance of occurrence. These events might happen occasionally, but not as frequently as the previous two levels.

4. Likely: “Likely” events have a high probability of occurring. While not certain, they have a strong chance of happening in the majority of cases.

5. Almost Certain: An event with an “Almost Certain” likelihood is expected to occur very frequently. It’s practically inevitable and is likely to happen in most situations.

Impact (Consequence) Levels:

1. Insignificant: An event with this consequence level would have very minimal or no impact on the project, organization, or objectives. It might lead to minor disruptions that can be easily managed and don’t significantly affect the overall outcome.

2. Minor: A “Minor” consequence signifies a slight negative impact that might cause some inconvenience or delays but can be managed with minimal effort. The overall project or objective is not significantly affected.

3. Significant: A risk event categorized as “Significant” would have notable consequences, potentially leading to moderate disruptions, increased costs, or some impact on the project’s schedule or objectives.

4. Major: A “Major” consequence implies a substantial impact on the project or organization. This level of consequence can result in significant delays, increased costs, and a noticeable setback in achieving objectives.

5. Severe: “Severe” consequences indicate a critical impact that can seriously endanger the project, organization, or objectives. It might result in major financial losses, reputational damage, or even legal issues.

Using the Risk Management Matrix

Once the Risk Management Matrix is created, it becomes a valuable tool for managing risks throughout the project and contract lifecycle:

1. Risk Prioritization: High-risk cells require immediate attention, while low-risk cells can be monitored with less intensity.

2. Contingency Planning: High-risk areas warrant the development of contingency plans and mitigation strategies.

3. Stakeholder Communication: The matrix helps in communicating risk information to stakeholders in a clear and easily understandable format.

4. Risk Mitigation: The matrix aids in identifying which risks should be addressed first. Resources and efforts can be directed towards mitigating high-priority risks, ensuring a more efficient use of resources.

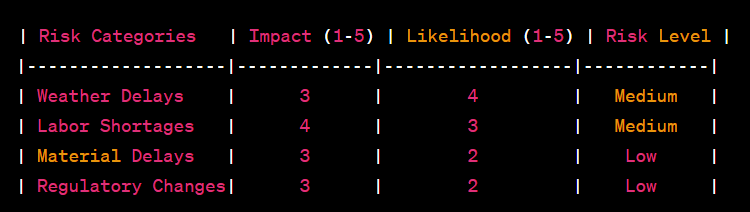

Real-Life Example: Project Risk Management Matrix

Let’s refer back to the construction project and illustrate the Risk Management Matrix with a simplified version:

In this example, the “Weather Delays” and “Labor Shortages” are identified as medium-risk areas due to their moderate impact and likelihood. The “Material Delays” and “Regulatory Changes” fall into the low-risk category.

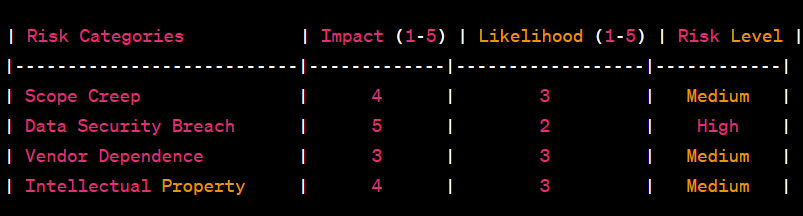

Real-Life Example: Contract Risk Management Matrix

Let’s also illustrate the Risk Management Matrix for the software development contract:

In this example, the “Data Security Breach” is identified as a high-risk area due to its high impact and low likelihood. The “Scope Creep,” “Vendor Dependence,” and “Intellectual Property” risks fall into the medium-risk category.

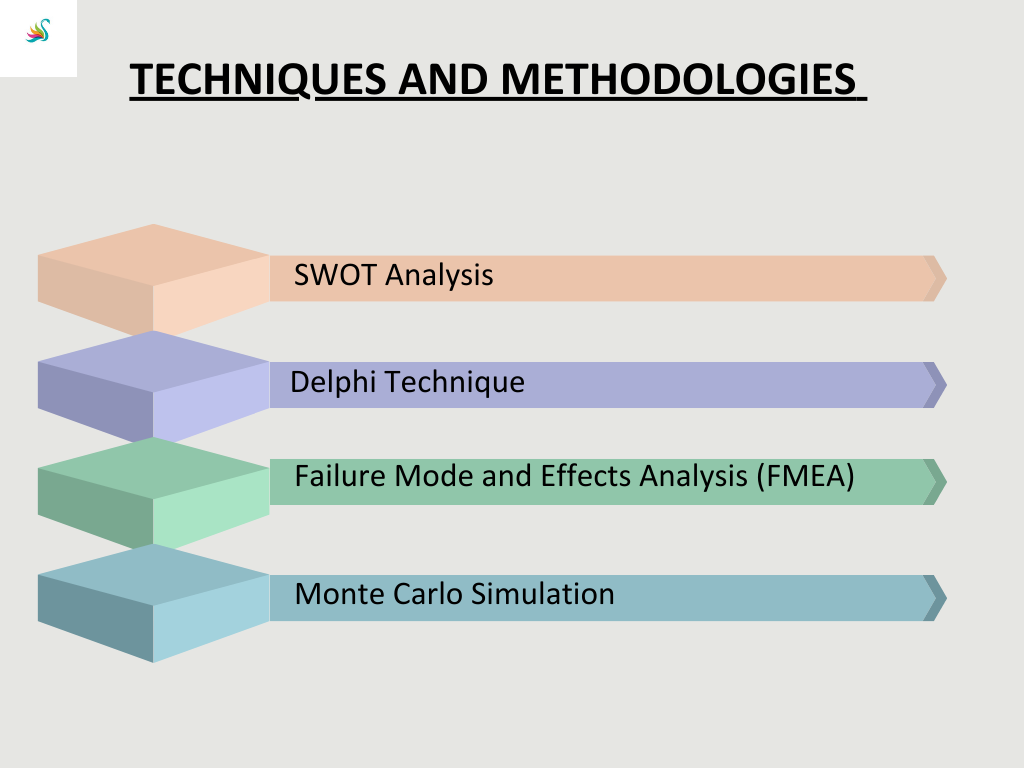

Techniques and Methodologies in Risk Management

SWOT Analysis

SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis is a versatile technique used to identify and evaluate risks and opportunities related to a project. It involves identifying the internal strengths and weaknesses of the project, as well as the external opportunities and threats it may face. By conducting a SWOT analysis, project teams can gain insights into potential risks and take advantage of opportunities.

Delphi Technique

The Delphi Technique is a group communication process used to achieve consensus on complex issues. In the context of Risk Management, it involves gathering opinions and feedback from a panel of experts anonymously. The panel responds to questionnaires or surveys, and their responses are analyzed and shared with the group. The process continues iteratively until consensus is reached on the identified risks and their impact.

Failure Mode and Effects Analysis (FMEA)

FMEA is a systematic approach used to identify and evaluate potential failures in a process, product, or system. It is commonly employed in high-risk industries such as aerospace, automotive, and healthcare. By analyzing the potential failure modes, their causes, and the consequences of each failure, project teams can prioritize risks and implement preventive measures.

Monte Carlo Simulation

Monte Carlo Simulation is a quantitative risk analysis technique used to assess the potential impact of uncertainties on project outcomes. It involves running multiple simulations of the project using random values for different variables and assessing the probability distribution of possible results. This technique helps project managers understand the range of possible outcomes and make informed decisions based on statistical probabilities.

Case Studies and Practical Insights

1. Case Study: Construction Project

In a construction project, the project team identified a risk related to the availability of skilled labor in the area. The impact of this risk was high as it could lead to project delays and increased costs. To mitigate this risk, the project team decided to collaborate with local vocational training centers to provide training to the local workforce, ensuring the availability of skilled labor during the project.

2. Case Study: Product Development Project

A technology company undertook a product development project with a tight deadline. During the risk identification process, the team identified a risk related to software compatibility issues with a third-party component. The impact of this risk was high as it could jeopardize the project’s success. To mitigate this risk, the team decided to conduct extensive compatibility testing during the development phase, ensuring that the third-party component seamlessly integrated into the product.

Practical Insights

- Early and Continuous Risk Management: Integrate risk management into the project from its inception and continuously review and update risks throughout the project lifecycle.

- Engage Stakeholders: Involve stakeholders from various domains in risk identification and assessment to gain diverse perspectives and ensure comprehensive risk coverage.

- Balance Risk Mitigation Costs: Evaluate the cost-effectiveness of risk mitigation strategies. Sometimes, investing heavily in mitigating low-impact risks might not be justified.

- Establish Contingency Plans: Develop contingency plans for high-priority risks to respond promptly in case the risk materializes.

- Monitor External Factors: Keep an eye on external factors that might influence risks, such as changes in regulations, market conditions, or political environment.

Conclusion:

Risk Management is a critical process in both project and contract management. It involves identifying potential risks, assessing their impact and likelihood, and developing strategies to mitigate or manage these risks effectively. By utilizing various techniques and methodologies, along with the Risk Management Matrix, project and contract managers can prioritize risks, make informed decisions, allocate resources efficiently, and ensure the successful delivery of projects and the smooth execution of contractual agreements. Real-life examples and case studies provide practical insights into how Risk Management strategies can be applied in different projects.