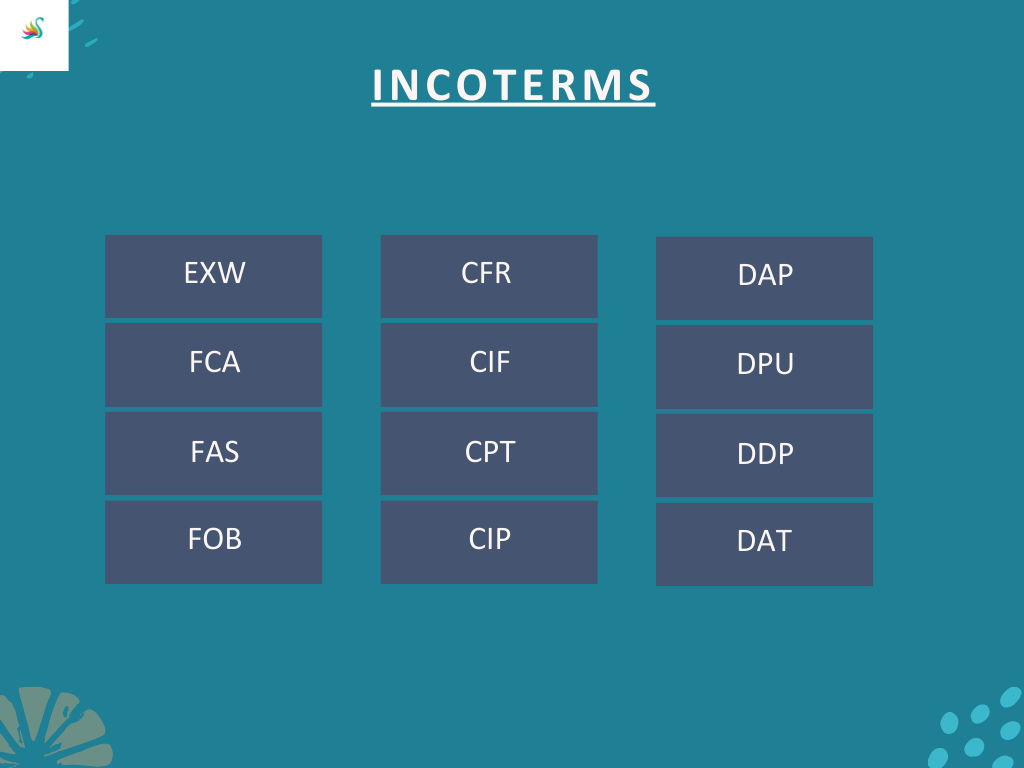

Incoterms: Understanding International Trade Terms

Introduction:

In the dynamic world of international trade, it is crucial for exporters, importers, and professionals involved in global business to have a clear understanding of Incoterms (International Commercial Terms). Incoterms are a set of standardized trade terms published by the International Chamber of Commerce (ICC) that define the rights and obligations of buyers and sellers in international transactions. These terms play a pivotal role in clarifying the division of costs, risks, and responsibilities between the parties involved in the sale of goods. In this chapter, we will delve deep into each Incoterm, backed by relevant examples and case studies, to provide readers with a comprehensive understanding of their applications and implications.

1. EXW – Ex Works:

Ex Works (EXW) is the simplest Incoterm, signifying that the seller fulfills their obligation when the goods are made available at their premises. The buyer is then responsible for all further transportation, export, import, and clearance processes. The risk transfers from the seller to the buyer at the point of collection.

Example: A German machinery manufacturer sells industrial equipment under EXW Hamburg to a South American buyer. The seller packages the equipment and notifies the buyer when it’s ready for pickup. The buyer arranges and pays for transportation, takes care of customs clearance, and assumes all risks during transit

2. FCA – Free Carrier:

Free Carrier (FCA) means that the seller delivers the goods, cleared for export, to the carrier or another party nominated by the buyer at the agreed-upon location. The risk transfers to the buyer once the goods are handed over to the carrier.

Example: A Chinese textile supplier sells a bulk order of fabrics to a U.S. clothing manufacturer under FCA Shanghai. The supplier arranges for the delivery of the fabrics to a designated freight forwarder’s warehouse. The risk passes to the buyer once the fabrics are in the hands of the forwarder.

3. FAS – Free Alongside Ship:

Free Alongside Ship (FAS) stipulates that the seller’s responsibility ends when the goods are placed alongside the vessel at the specified port of shipment. The buyer bears the risk and cost of loading the goods onto the ship and subsequent transportation.

Example: An Australian seafood exporter sells a shipment of lobsters to a European buyer under FAS Sydney. The exporter delivers the lobsters to the Sydney port, and the buyer arranges for loading them onto the vessel. Once the lobsters are beside the ship, the risk transfers to the buyer.

4. FOB – Free on Board:

Free on Board (FOB) indicates that the seller completes their obligations when the goods are loaded onto the vessel at the designated port of shipment. The buyer takes charge of the goods and bears all risks and costs from that point onwards.

Example involving Shell: A Middle Eastern oil producer sells a cargo of crude oil to Shell under FOB Dubai. The oil producer ensures the crude oil is loaded onto the vessel nominated by Shell at the Dubai port. Once the crude oil is on board, Shell assumes responsibility and risk for the shipment during transit.

5. CFR – Cost and Freight:

Cost and Freight (CFR) means the seller arranges and pays for the transportation of the goods to the specified port of destination. The risk transfers to the buyer once the goods are loaded onto the vessel. However, the seller is not responsible for insuring the goods during transit.

Example: An Indian steel manufacturer sells a shipment of steel coils to an African importer under CFR Mumbai. The Indian seller organizes and covers the freight costs to transport the steel coils to the African port. The risk transfers to the buyer when the coils are on the vessel.

6. CIF – Cost, Insurance, and Freight:

Cost, Insurance, and Freight (CIF) is similar to CFR, with the addition of the seller being responsible for obtaining and paying for marine insurance to cover the goods against damage or loss during transit.

Example: An Indonesian electronics supplier sells a shipment of smartphones to a New Zealand retailer under CIF Jakarta. The Indonesian seller arranges transportation and covers the freight costs and insurance. The risk and responsibility transfer to the buyer when the smartphones are loaded onto the vessel.

7. CPT – Carriage Paid To:

Carriage Paid To (CPT) means the seller is responsible for the delivery of the goods to the carrier or another party nominated by them at the agreed-upon place. The risk transfers to the buyer when the goods are in the hands of the carrier.

Example: A Brazilian coffee exporter sells a container of coffee beans to a Canadian coffee roaster under CPT São Paulo. The Brazilian seller arranges for the transportation and delivers the coffee beans to the carrier. The risk shifts to the Canadian buyer upon delivery to the carrier.

8. CIP – Carriage and Insurance Paid To:

Carriage and Insurance Paid To (CIP) is similar to CPT, with the added provision that the seller must obtain and pay for insurance covering the goods against damage or loss during transit.

Example: A South African diamond supplier sells a shipment of rough diamonds to a Belgian diamond trader under CIP Cape Town. The South African seller arranges transportation and insurance coverage for the diamonds. The risk passes to the Belgian buyer once the diamonds are with the carrier.

9. DAP – Delivered at Place:

Delivered at Place (DAP) means the seller is responsible for delivering the goods to the buyer at the agreed-upon place of destination, not unloaded. The risk transfers to the buyer upon delivery.

Example: A Mexican furniture manufacturer sells a container of wooden furniture to a European retailer under DAP Mexico City. The Mexican seller arranges transportation and delivers the furniture to the retailer’s specified location. The risk shifts to the buyer once the goods are delivered.

10. DPU – Delivered at Place Unloaded:

Delivered at Place Unloaded (DPU), formerly known as Delivered Duty Paid (DDP), places the maximum responsibility on the seller. The seller is accountable for delivering the goods to the buyer, unloaded, and ready for import, covering all costs and risks until delivery.

Example: A Japanese electronics company sells a shipment of laptops to an Australian retailer under DPU Tokyo. The Japanese seller handles transportation, customs clearance, and unloading at the retailer’s premises in Australia. The risk remains with the seller until the laptops are successfully unloaded and handed over.

11. DDP – Delivered Duty Paid:

As of the 2020 revision, Delivered Duty Paid (DDP) has been removed from the Incoterms rules, and it has been replaced by DPU (Delivered at Place Unloaded). The term is no longer recommended, but it’s essential to understand its implications for older contracts still using it.

Example: An Italian luxury goods manufacturer sends a high-value order to a buyer in China, handling all expenses and formalities.

12. DAT -Delivered at Terminal:

The seller delivers the goods to a designated terminal at the destination, with the risk shifting from the seller to the buyer upon arrival at the terminal.

Example: An Indian pharmaceutical company sends a shipment to a distribution terminal in the United States.

Advantages and Disadvantages

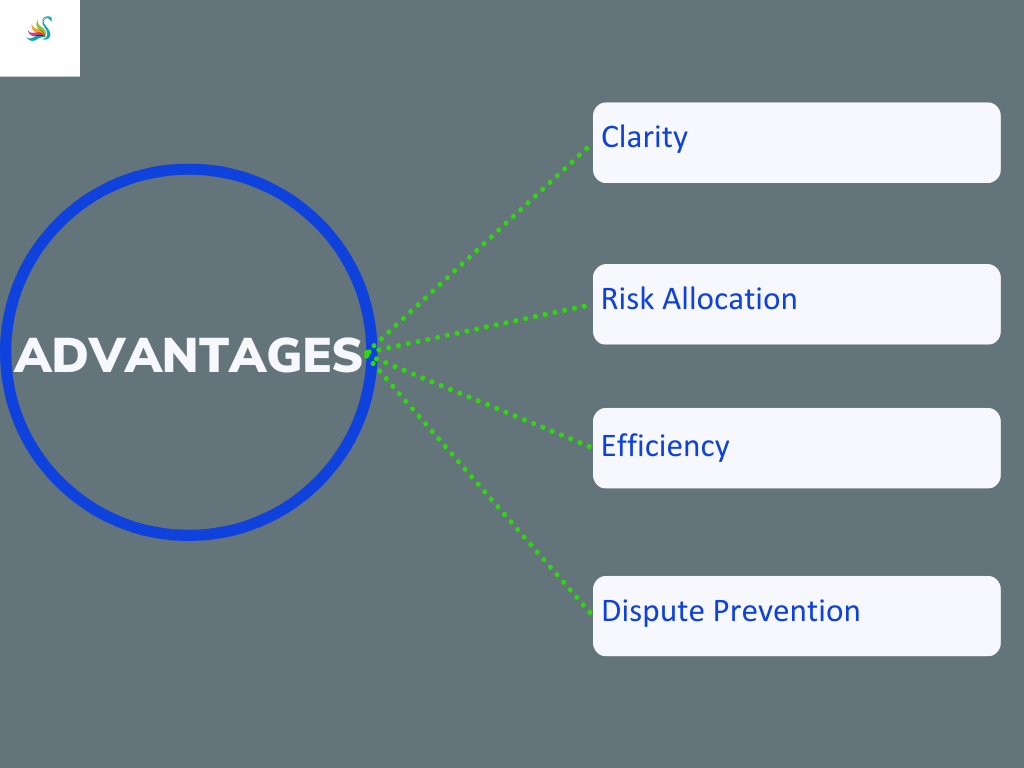

Advantages:

1. Clarity: Incoterms provide a common language for global trade, reducing misunderstandings.

2. Risk Allocation: Incoterms clearly define when the risk transfers from the seller to the buyer, aiding risk management.

3. Efficiency: With responsibilities clearly outlined, trade processes become more efficient.

4. Dispute Prevention: Well-defined responsibilities reduce the likelihood of disputes and legal conflicts

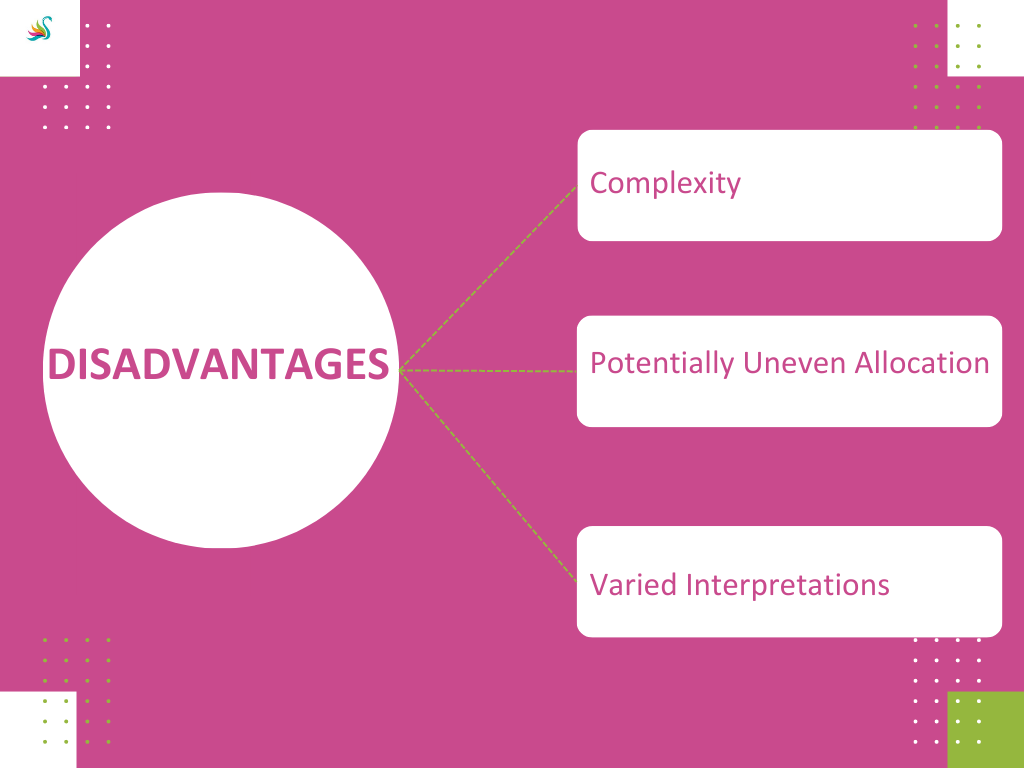

Disadvantages:

1. Complexity: Choosing the right Incoterm requires a deep understanding of trade processes and regulations.

2. Potentially Uneven Allocation: Certain Incoterms might allocate more responsibilities to one party, potentially leading to disputes.

3. Varied Interpretations: Misinterpretations can still occur, emphasizing the need for clear communication.

Selecting the Right Incoterm:

1. Assess Your Priorities: Understand your main concerns, whether it’s cost control, risk management, or control over the shipment.

2. Analyze the Trade Route: Consider the transportation mode, distance, and potential risks involved.

3. Consult Experts: Legal professionals and industry experts can provide valuable insights based on your specific circumstances.

4. Communicate with Counterparties: Open dialogue ensures both parties are on the same page regarding responsibilities and expectations.

5. Draft Clear Contracts: Document all terms in detail to prevent misunderstandings and disputes.

Conclusion:

Understanding Incoterms is paramount for anyone engaged in international trade. These standardized terms facilitate seamless communication between buyers and sellers, eliminate uncertainties, and ensure a clear allocation of costs and risks. Throughout this chapter, we explored each Incoterm with detailed explanations, examples, and case studies. Moreover, we examined an example involving Shell, a prominent transportation company, to enhance readers’ comprehension further. Armed with this comprehensive knowledge, professionals can navigate international transactions with confidence, promoting successful and efficient global trade relationships.